Cash App is an excellent online money transfer service. Cash App is a wireless money transfer and receiving app that also comes with a free debit card. However, several consumers claim that using a Cash App account to make a purchase is problematic.

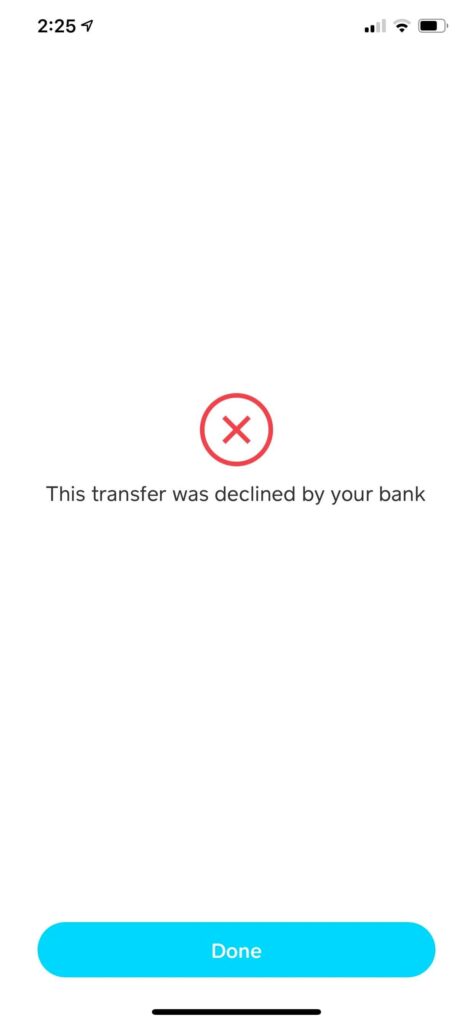

One of the most common errors on Cash App is “Your Bank Declined This Payment”.

There can be a few different reasons why you might get the “Your Bank Declined This Payment” error on Cash App. Here are some of the most common causes:

- Insufficient Funds – If you don’t have enough money in your account to cover the payment, your bank will decline it. Make sure you have enough funds before trying to make a payment on Cash App.

- Invalid Card Information – If you entered incorrect card information (expired card, wrong card number, etc.), your bank will declined the payment. Make sure all of your card information is correct before trying to make a payment.

- Blocked Cards – Sometimes banks will block payments from certain types of businesses or for certain amounts. If your bank has blocked the payment, you’ll need to contact them to unblock it.

- Fraud Protection – If your bank suspects that the payment is fraud, they may decline it. If you think this is the case, you’ll need to contact your bank to discuss the payment.

If you’re still having trouble, please contact Cash App support and they’ll be happy to help.

This transfer failure on Cash App is a common problem for many users. There may be a number of reasons why your Cash App payment declined, and we’ll go over every one of them here.

Table of Contents

Why Was My Cash App Payment Denied?

When you use Cash App, many things are happening behind the scenes to ensure that you get the best experience possible. So when you see a message saying that your payment has been declined, it may happen due to the following reasons:

- Wrong details were entered: Cash App users often report that their payment failed on Cash App, but they forget to check the payment information they entered during the transaction. If you input the incorrect card information, the Cash App transfer page turns red, indicating that the transaction failed. You can double-check your payment information and start transferring money from your Cash App account again.

- Insufficient funds in your Cash App account: Before concluding that your Cash App has failed, review your account balance. Cash App transaction may fail if the account balance is inadequate. As a result, before withdrawing money from your Cash App account, you should always check your account balance.

- Poor connection or internet not working: A high-speed internet service is needed to process payments on a Cash App account. Cash App transactions are denied if there are no Wi-Fi networks available or if the device’s internet is down. This is to prevent double transactions or any other problems that may occur due to the weak internet connection.

- The bank has declined the transfer: Yes, it is likely that payments would be rejected by the bank owing to server problems. If you’re wondering why my bank is rejecting Cash App transfers, you can email your bank’s customer service team.

- Your cash card or account is disabled: You may see an error if your cash card or account is blocked. As a result, double-check that both your Card and Cash App Accounts are active.

- CashApp must be updated: If the Cash App version is older than the most recent version available, the transaction can fail because Cash App strives to have the best protection possible, and older versions lack security as opposed to the most recent.

These are the most common causes for Cash App transaction declines or failure notices, as mentioned below.

So How Can You Solve The Payment Declined By Bank Warning?

The solutions, on the other hand, are convenient and straightforward. However, while most of them can be resolved entirely on our end, others would need immediate assistance from Cash App Customer Service, which is available 24 hours a day, seven days a week, to address the problems.

When making the transaction, make sure you’re linked to a secure internet connection or reliable WiFi. Also, check to see if your balance is adequate for the transaction; if it isn’t, transfer less money or add more funds to your account. Always double-check that all of the information in your Cash App is right, such as your name, date of birth, bank account information, and so on.

If you get a notice that a Cash App upgrade is available, you should always update your app. Also, check to see whether your Cash App Card has been blocked; you can get confirmation from customer service.

If none of these are associated with your card getting declined, then it is likely that your bank has cancelled the transaction. How will the bank cancel a transaction that you send through the Cash App? They certainly will. That is, they may either hold the payment, reject it, or refuse the transaction altogether.

The point of debate is why does a bank do such a thing. They will do that if they suspect suspicious or fraudulent behaviour from your account. For example, if you haven’t used the account in a long while and want to withdraw all of the money at once, this might seem suspicious, and so your bank may block the transaction.

So, what’s the solution?

The only solution, in such a case, is to call the bank or go to the closest branch and explain the situation to them. The bank would release the hold on the account, allowing you to transfer money without delay.

Frequently Asked Questions

Q: Why does Cash App keep declining my payment?

A: Cash App keeps an eye on your account for anything out of the norm. Cash App will refund all potentially fraudulent payments to protect users from being charged. The money will be returned to the user’s Cash App balance or related bank account immediately if this occurs.

Q: What does it mean when Cash App says your bank declined this payment?

A: If you get a message from Cash App saying that your bank has declined the payment, it might be because the Cash App server is down. Other reasons include using unsupported debit or credit cards for transactions.

Q: Can I use my Cash App card if my account is closed?

A: No, you cannot use your Cash App card if your account is closed or blocked unless you contact customer support and get your account unblocked. When your account gets blocked, your mobile access will also terminate.

Q: How can I use Cash App without card?

A: You can perform transactions on Cash App despite not having a debit card or not having it handy. To do so, tap on the “No Card?” option on Cash App and then choose your bank from the list. After selecting your bank, you will be asked to provide your credentials.